Online - Making your payment online is fast, easy, and safe. It's also convenient, since you can make a payment 24 hours a day, from anywhere with an internet connection! Log into MyWWC and click on Student Accounts to see your balance and make payment. In just a few minutes, your transaction will be complete. You can choose to pay by using a Checking Account ACH Payment (e-Check) with no fees, or a Credit Card Payment; convenience fees apply to credit/debit card payments.

Check or Money Order – Made payable to “Warren Wilson College.” On the memo line, please write the Semester and Student ID # or name and mail to: Warren Wilson College CPO 6362, PO Box 9000, Asheville, NC 28815-9000

Cash – Cash payments (exact change only) are accepted in person during cashier window (Ogg building, 2nd floor, Room 204) hours.

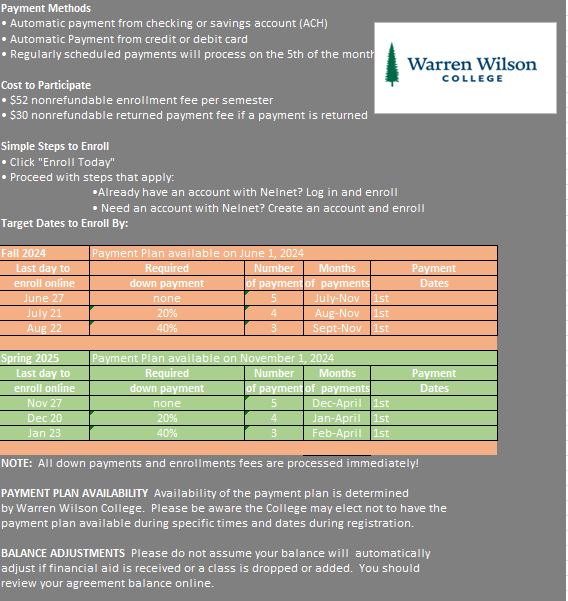

Monthly Payment Plans - Nelnet

Interest-free monthly payment plans are available for Fall and Spring through Nelnet. There are no payment plans available for the Summer session.

You must establish your payment plan with Nelnet before the college can consider the plan as a form of payment on your WWC account. You will be able to see the payment schedule and monthly installment amounts when you set up the plan on the payment plan site before you finalize it. Enrollment fee and late fees apply. All payments are due on the first of each month.

How to set up a plan:

Students can sign-up for a payment plan by clicking this link Nelnet Payment Plan and follow the instructions on enrolling. For help registering call Nelnet customer service (800) 609-8056.

- You’ll need to register a new user name and password unless you have an existing Nelnet account from a previous institution.

- If someone is paying your behalf, you MUST first set them up as an Authorized Payer(s)

- Authorized Payer: If you are paying on behalf of the student, the student must set up their account first and then add you as an Authorized Payer

- Enter amount due, select number of payments, and select payment type. All payments are automatic from a bank account or credit card

- Pay enrollment fee ($52) and first installment or down payment

You must enroll by the enrollment deadline to secure a 5-month plan. Late plans will require a down payment as listed below. All plans require automatic payment.

How much should you set up your plan for?

- Payment plan enrollees are responsible for uploading the payment plan amount. WWC does not share that information with the payment plan vendor

- Find the anticipated balance due on your account by logging into MyWWC and clicking Billing&Aid, then Student Account. Under View&Pay Account, click Generate Course and Fee Statement (parents can view this under My Student Information). Generate the Statement to view the Total Ending Balance with unearned work deducted.

- If you do not have an account or are not yet registered for the upcoming semester, use this 24-25 Financial Policy, Withdrawal and Reduction of Charges Policy to estimate the charges based on whether you will be on or off campus, a new student or a returning student. Subtract your financial aid offer for the semester.

After your plan is approved (and enrollment fee / first installment paid), the FULL AMOUNT of your payment plan will be applied to your Student Account as a credit. You will see it listed on your WWC account as "Payment Plan Contract - Nelnet”. If that has been applied to your account and there is still a balance due, then the payment plan is not enough to cover the bill. You can log into your payment plan account and increase the amount of your payment plan, or pay the difference on MyWWC.

If the plan is cancelled for inactivity the credit on the Student Account will be reduced to the amount actually paid, and the remaining balance will be due immediately. Registration may be locked for non-payment of accounts.

State Prepaid Tuition or College Savings Plans - If you have documentation of the amount of payment that will be made to your account by a third party state prepaid tuition or college savings plan (e.g. a 529 Plan or Florida Prepaid), provide it to the Student Accounts Office to request a deferral. Contact the third party early to authorize disbursement to Warren Wilson College. Deferrals are lifted soon after the beginning of the semester. If the deferred payment does not arrive, for whatever reason, the balance due must be paid immediately to keep the account in good standing.

Outside Scholarships - Click here to view Warren Wilson College's Financial Aid Office's outside scholarship information. If you have received an outside scholarship, send a copy of the award letter to the Financial Aid Office as soon as possible.

Veterans' Administration Benefits - If you have documentation (such as a certificate of eligibility) that you are eligible for VA benefits, provide it to the Financial Aid Office. If the payment does not arrive, or varies from the deferred amount, the balance due must be paid immediately to keep the account in good standing.

For information on VA benefits, please contact the Financial Aid Office.

PLUS Loan - A parent may apply for a Federal Direct PLUS Loan. Click here for information from the Financial Aid Office regarding the application process.

Private Student Loan - Students may apply for private consumer loans in order to supplement their financial aid. Click here for information from the Financial Aid Office regarding the application process.