Federal Direct Student Loans are borrowed directly from the federal government, and eligibility is determined by the Free Application for Federal Student aid (FAFSA). There is not a separate application for Federal Student Loans. Federal Direct Loans are offered to help pay educational expenses so please, only borrow what you need.

Even if you are ineligible for need-based aid, you will still qualify for the lower-interest Direct Unsubsidized Loan and a Direct PLUS Loan for Parents.

For more information about Federal Direct Student Loans including interest rates, and origination fees CLICK HERE.

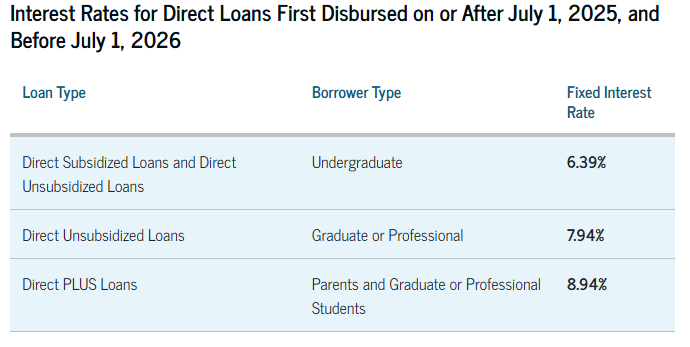

Direct Loan Interest Rates for 2025-2026

An origination fee is a percentage of your loan amount charged by the lender for the processing of your loan. Federal student loans have an origination fee; therefore, the amount you may receive as a disbursement may be slightly lower than the amount you accept.

Eligibility:

- Students who complete the FAFSA are applying for all aid programs in which they may be eligible, including direct loans.

- Student loans are offered on a student's Financial Aid Offer if they completed a FAFSA and are eligible.

- Federal Direct Student loans are not required but are offered to help cover educational expenses.

- Students must be enrolled at least half the time to be eligible for Federal Student Loans. Warren Wilson College defines half-time as 6 credit hours.

In order for us to process your Direct Loan, you must complete a three-step process:

- Accept the direct loans on the "Financial Aid Offer" tab of your Financial Aid Portal.

- Complete Entrance Counseling. This is a twenty-minute online tutorial designed to acquaint first-time Direct borrowers with the rights and responsibilities for this educational loan. * If you have previously borrowed at Warren Wilson College through the Federal Direct Loan Program, you are not required to complete Entrance Counseling again. However, it is highly recommended that you do so!

- Complete a Master Promissory Note (MPN) with the Federal Department of Education. * If you have previously borrowed at Warren Wilson College through the Federal Direct Loan Program, you will not need to complete a new MPN.